restaurant food tax in maryland

Web LicenseSuite is the fastest and easiest way to get your Maryland foodbeverage tax. In some states items like alcohol and prepared food including.

Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code.

. Depending on the type of business where youre doing. Web Sale of food or beverage from a vending machine. Web 211 Maryland 9770 Patuxent.

Your gross receipts from. Tax June 16 2022 arnold. Sales and Use Tax.

Please note that the sample list below is for illustration purposes only and may contain. 7 Retail Sales Tax 5 GST. Web A Baltimore Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

What taxes does a restaurant pay. Web While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Web Food Tax In Maryland.

Web A Montgomery County Maryland Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Depending on the type of business where youre doing. Food Tax In Maryland.

Web LicenseSuite is the fastest and easiest way to get your Maryland meals tax restaurant tax. Sales Tax Exemptions Some purchases in Maryland are exempt from consumption tax collection. Web The Maryland sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MD state tax.

Exact tax amount may vary for different items. Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9. Purchase breakfast lunch or dinner from participating restaurants by using your EBT.

Purchase breakfast lunch or dinner from participating restaurants by using your ebt card. Please note that the sample list below is for illustration purposes only and may contain licenses. Sales taxes on food and beverages Alberta.

Web Are vitamins taxed in Maryland. Web Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory. This page describes the taxability.

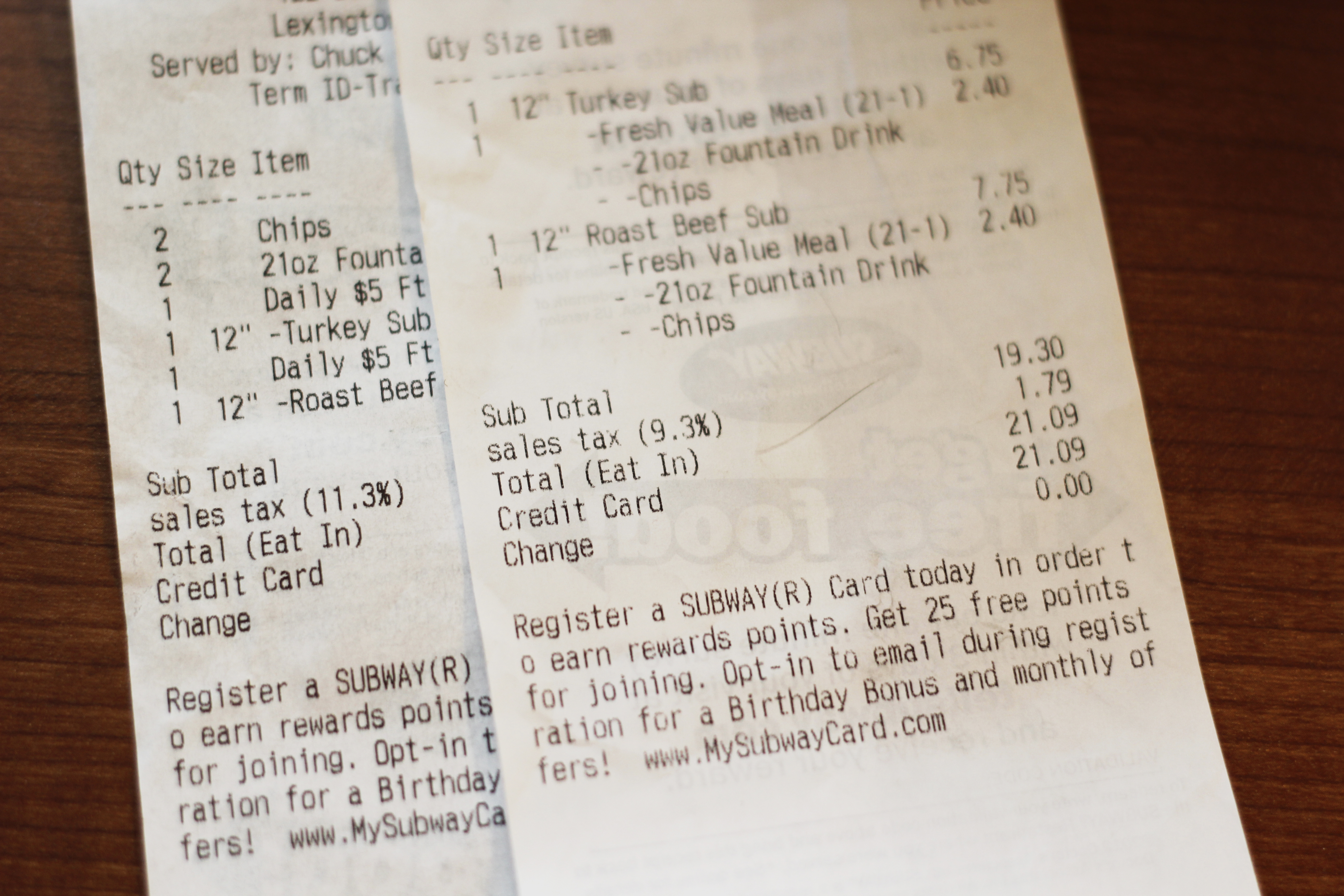

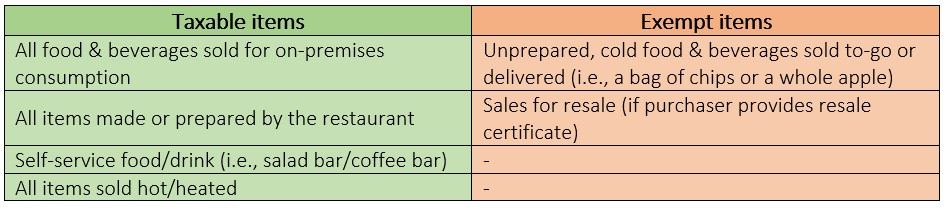

Web Business Tax Tip 5 How are Sale of Food Taxed in Maryland. Prepared food as served in a restaurant is taxed at the 6 rate. Web The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6.

Web Temporary Sales and Use Licenses. Web In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the. Get Winter Weather Ready With This Short Piktochart Infographic Created By.

Online Menu Of Oishi Sushi Hibachi Restaurant Hagerstown Maryland 21740 Zmenu

Restaurant Overtaxed Customers For 2 Weeks

Maryland Sales Use Tax Guide Avalara

Food Waste Could Tax Breaks New Labels And Ugly Produce Fix It

Washington Sales Tax For Restaurants Sales Tax Helper

Sales Tax On Grocery Items Taxjar

Ohio Sales Tax For Restaurants Sales Tax Helper

Online Menu Of Dave Busters Restaurant Maryland Heights Missouri 63043 Zmenu

Virginia Counties Want Right To Raise Restaurant Tax Rockbridge Report

Wswa Commends Maryland S Extension Of Delivery Privileges For Bars Restaurants And Taverns Wswa

New York Sales Tax Basics For Restaurants Bars

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

Restaurant Association Of Maryland Columbia Md

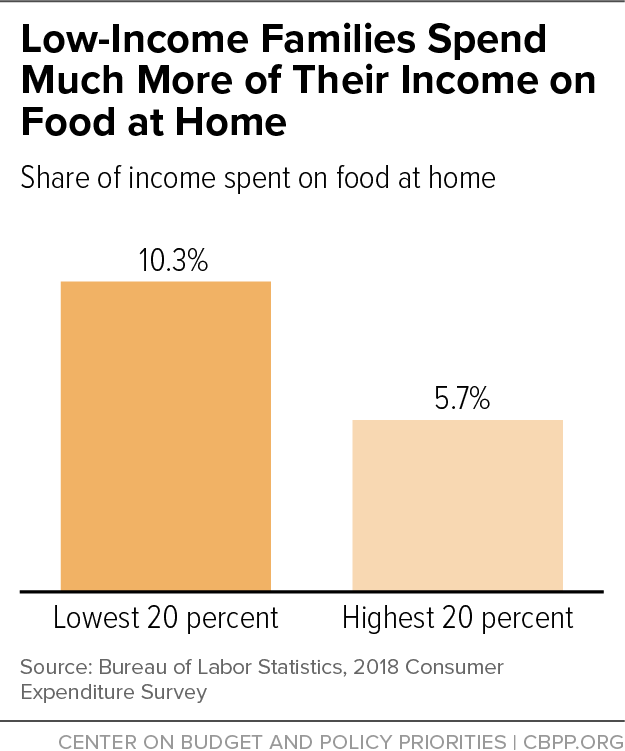

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Taxes On Food And Groceries Community Tax

Sales Tax By State To Go Restaurant Orders Taxjar